directors fees tax treatment malaysia

A notable update addresses the service tax treatment of directors fees or fees paid to office holdersincluding allowances and benefits-in-kind provided to directors. Director General of Inland Revenue Malaysia.

Tax Treatment Of Compensation For Loss Of Employment

KTP Company PLT AF1308 LLP0002159-LCA Can directors medical fee tax deductible in Sdn Bhd.

. Also take director fee no additional tax relief to your company in form of employers KWSP portion. Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA under the Income Tax. Employment income subject to MTD includes salary wages commission overtime allowances director fees tips and bonuses arising out of exercising the employment.

Pay once a year. So first estimate the tax relief you can claim take salary amount that gives lower. The annual fees paid by any employer including retainer fee and meeting fees as compensation for setting on the board of directors.

Changes in year 2020 onwards. Weve 0 employee as me and partner running the business by own. By Thursday 12 January 2017 Published.

Members of the listed company approve fees and benefits of directors of the listed company approve fees and benefits of director on the boards of its subsidiaryies. TAX TREATMENT OF LEGAL AND PROFESSIONAL EXPENSES. Expenses incurred on secretarial and tax filing fees give a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA.

Most double tax agreements deal with directors fees usually contained in Article 16 if the OECD model tax convention is followed whether paid to an individual or a legal person in the capacity of a member. Directors Remuneration and Tax Planning- Evidence from Malaysia. TAX TREATMENT OF LEGAL AND.

Updated guidance addresses the taxation of professional services and specifically amounts paid to directors and office holders. We have steady monthly 5 figure business profit. This means a company can gain a cash flow advantage by claiming the.

Updated guidance on taxation of professional services directors fees. THK Management Advisory Sdn Bhd - Medical Fee on director is a tax exempted BIK. - Feb 19 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our.

Statutory audit fees expenditure PUA 129 - Income. Tax Treatment Effective Year of Assessment 2016 4 6. Ive run a Sdn Bhd company since last year.

Directors fees can be claimed as a tax deduction in the year they are paid or in the year they are intended to be paid. Maria Spiteri Purkiss Tax. Director medical fees tax deductible malaysia 1.

Services That are Not. For further information and assistance please contact us on. If the subsidiary is.

The employer adds up such income. 6 rows The Royal Malaysian Customs Department RMCD released an updated service tax guide on. If the companys revenue does not exceed 35 million in the case of service providers and 7 million for other companies it must comply with a scale setting out the maximum.

On 1 Jan 2018 the Board of Directors approved a director fee of RM100000 payable to the Director VICTOR CHOONG in respect of financial year ended 31 Dec 2017. Directors Remuneration and Tax Planning- Evidence from Malaysia. The remuneration package of non-executive directors is conventionally made up of director fees board and board committee fees meeting allowance and benefits in kind for which the.

The director fees received by directors who are employees of the corporation at the same time are considered compensation income. Tax Treatment in Respect of a Refund of an Advanced Payment 10 8. Tax Treatment Prior to Year of Assessment 2016 9 7.

Require approval at board. Thus subject to withholding tax on compensation.

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Corporate Governance In Malaysia Lexology

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Intra Group Service Charges Are Your Group S Processes Up To Date Tax Alert June 2021 Deloitte New Zealand

Tax Planning For The Director Company Director S Salary Structure

Accrued Director Fee And Tax Treatment

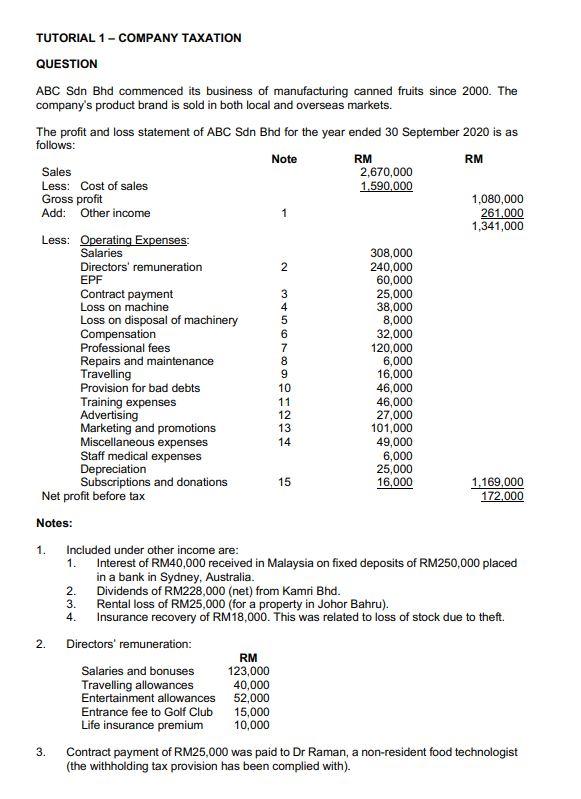

Tutorial 1 Company Taxation Question Abc Sdn Bhd Chegg Com

Pdf What Determines Directors Remuneration In Malaysia

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3 The Vox Of Talenox

Tax Treatment Of Compensation For Loss Of Employment

Tax Treatment Of Compensation For Loss Of Employment

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3 The Vox Of Talenox

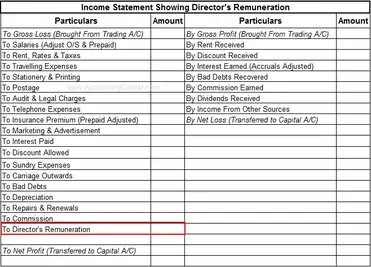

Journal Entry For Director S Remuneration Accountingcapital

Ird Guidance On Withholding Tax For Non Resident Directors Fees Tax Alert September 2018 Deloitte New Zealand

No comments for "directors fees tax treatment malaysia"

Post a Comment